This article is part of our Business Strategies series, an insight and analysis into the makeup and model of some of the world's most successful startups.

A global audio streaming service that allows users to listen to music and podcasts, Spotify has revolutionised the already-volatile and dynamic world of music distribution. It has enabled an incredible shift in how we consume audio content, while also ensuring that artists are paid royalties for their work; with nearly 250 million monthly users, the service can justifiably be dubbed as the Netflix of the audio world.

But how did Spotify go from a small Stockholm back office to an international technology titan? We've taken a magnifying glass to the Spotify business model to identify the secrets of their strategy, as well as what you – as a business owner – can learn from it.

Vital Information

SpotifyInside the Stockholm headquarters of Spotify

SpotifyInside the Stockholm headquarters of Spotify

- Founded: April 2006

- Founders: Daniel Ek and Martin Lorentzon

- Headquarters: Luxembourg City, Luxembourg (Legal) / Stockholm, Sweden (Operational)

- Current CEO: Daniel Ek

- Global Employees: 3,651 (December 2018)

- Type: Public (Floated February 2018)

- Initial Funding: $2.7bn in 22 funding rounds

- Key Products / Services: Audio streaming and content distribution

As with all companies, it's first pertinent to identify Spotify's original goals, as evidenced in their mission and vision statements:

To unlock the potential of human creativity by giving a million creative artists the opportunity to live off their art and billions of fans the opportunity to enjoy and be inspired by these creators.

We envision a cultural platform where professional creators can break free of their medium's constraints and where everyone can enjoy an immersive artistic experience that enables us to empathise with each other and to feel part of a greater whole.

History

Developed in 2006, Spotify was initially envisioned as a means of tackling the significant piracy problem within the music industry. As co-founder and current CEO Daniel Ek told The Telegraph in a 2010 interview, “I realised that you can never legislate away from piracy”. The only solution was to "create a service that was better than piracy and at the same time compensate the music industry".

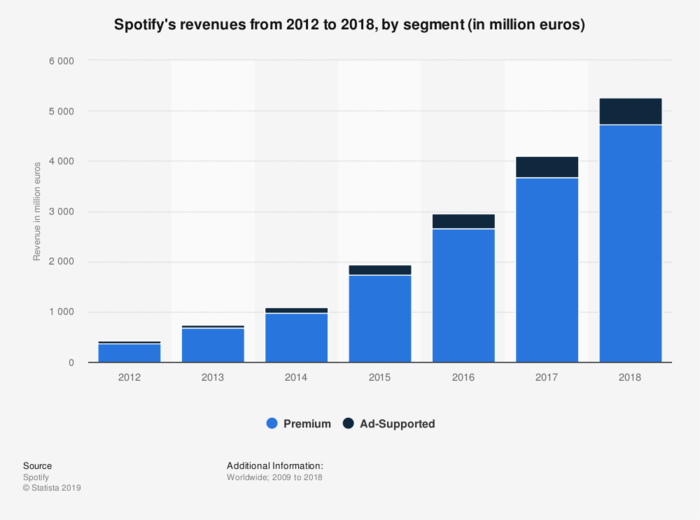

Spotify's revenue model was something that did just that, securing key agreements with major record labels and offering limited free subscriptions alongside paid variants. It has since grown into a content streaming behemoth, creating an impressive library of artists, songs and podcasts which users can freely access through its app.

Spotify's Business Model

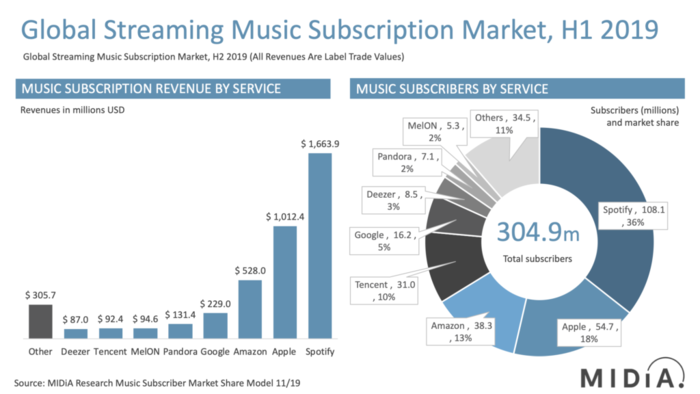

The diversity of this business model is undoubtedly the key to Spotify's popularity. Indeed, the company operates two types of model in unison: a freemium and subscription-based service, with subscriptions accounting for around 91% of its revenues and freemium representing the other 9%.

The freemium service offers users all the basic features of the platform, but without a monthly charge; they can build a library, share content, view lyrics and use Spotify Radio. However, to cover the cost of providing these features, Spotify places advertisements inside the material and installs automatic music videos to generate ad revenue.

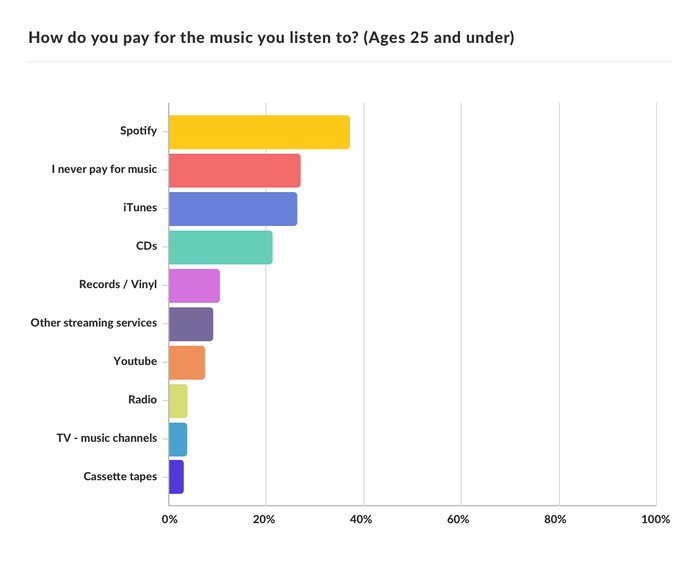

Of course, with millennial and Gen Z users – the app's prime customer base – being so wary of advertising saturation, there is the need for an alternative; upgrading to the subscription-based premium service. This account allows users (and up to six other people) to listen to commercial-free music, download songs and podcasts, utilise unlimited skips and access content offline. In the US, the student account also extends an ad-supported Hulu plan, SHOWTIME, and on-demand playback, while free three-month trials are also available.

StreetbeesA 2018 survey asking over 1100 young people in the US and the UK how they access music

StreetbeesA 2018 survey asking over 1100 young people in the US and the UK how they access music

In 2016, the company expanded this revenue model by introducing ten new advertising formats. These have included:

- Branded Moments: Allowing brands to share stories with sequential displays during 30-minute sessions.

- Branded Playlists: Playlists that have branded cover art images and text.

- Sponsored Playlists: A one-week sponsorship of top playlists.

- Sponsored Sessions: Permitting brands to provide audiences with uninterrupted listening in exchange for a video view.

- Traditional: Enabling display ads (clickable images shown for 30 seconds), homepage takeovers (background skin by an advertiser), audio ads (15- and 30-second commercial ad breaks every 15 minutes) and overlay (large welcome back display ad by Spotify).

Another essential aspect of the Spotify business model is how it remunerates artists. Under its platform, the company pays royalties based on the number of artists' streams as a proportion of total songs, distributing around two-thirds of its total revenues to rights holders. This model is not without controversy; Spotify has received criticism over how much it pays out (estimated to be between $0.006 and $0.0084 per stream), with artists claiming that they receive even less and are not fairly compensated. Spotify has attempted to rectify these complaints by experimenting with various mechanisms, including making music licensed to Universal Music Group or Merlin Network temporarily exclusive to paid subscribers.

Spotify

Spotify

All in all, the company generates around $5bn in annual revenues, although only recently has it begin to turn a profit. In early 2019, this operating profit was reported to be around $107m, although executives are warning that this may not indicate a trend and that greater losses are expected moving forward. However, the company's key performance indicators (KPIs) are also worth considering, notably that:

- 90% of Spotify's revenues are created by 30% of its users.

- The average revenue per user is $5.40.

- Every ad served costs between $0.015 and $0.025.

- Its conversation rate topped 46% in 2019, up from 26.6% in 2013.

- An average user spends 148 minutes a day on Spotify.

These are important metrics to gauge Spotify's overall success, with the company keen to enhance its grasp of user behaviour by rolling out new data analysis capabilities (including learning what listeners do after they click). Ultimately, it is fair to say that the company is generating revenues, but it is hardly creating profit. Nevertheless, investors remain bullish, with stock value surging by approximately 30% in 2019.

Value

Spotify offers value in several ways, both to consumers and the music industry. Although piracy still exists, more users are now preferring to adopt legal streaming services, meaning that musicians and record companies are happier than before; in turn, this encourages those same labels and musicians to license their material for use on Spotify.

This is where Spotify's value is most apparent. Although other free streaming services exist, none have the catalogue and back library of music available to users that Spotify does, which is what separates it from competitors. After all, other companies may build better apps and offer more flexibility, but if users can't listen to their favourite artists, then they are not likely to stick around.

Jean_Nelson / Deposit PhotosUS pop star Taylor Swift is among those who have previously been critical of the Spotify model

Jean_Nelson / Deposit PhotosUS pop star Taylor Swift is among those who have previously been critical of the Spotify model

Spotify has also produced value in other ways, too, such as giving marketers a new avenue through which to advertise to consumers, offering new artists an opportunity to gain exposure, and adapting to consumer trends through personalised content suggestions and offline consumption.

Partners

Primarily, of course, Spotify depends on these relationships with record labels and artists. However, as an established market leader, it's worth noting the company's partnerships across other industries, and with some of the world's largest brands.

In January 2015, for instance, Sony announced that its music service, PlayStation Music, would have Spotify as an exclusive partner, giving the company access to 41 markets around the world. Two years later, Spotify partnered with the South by Southwest (SXSW) conference by offering specific audio in exclusive playlists designed for the SXSW hub. That same year, Microsoft confirmed it was no longer working with Groove Music, a streaming service, and would instead establish a new partnership with Spotify. In early 2018, Spotify announced another two key partnerships: with Discord and Hulu. Discord enables desktop users to display on their profiles what music they are listening to, while Hulu and Spotify launched an entertainment bundle for university students. Samsung has also endorsed Spotify as is its go-to music provider.

This list is only growing, too. Spotify is creating a new streaming hub for families with Disney, while Spotify Premium will be extended to select American and British Xbox Game Pass Ultimate members. It will also come together with various global brands, including Brazil's Magalu Conecta, Australia's Vodafone and France's Bouygues Telecom, while it has lucrative partnership agreements with telecommunications providers all over the world.

Key People

Since its inception, Spotify has operated under the leadership of at least one of its two co-founders, Ek and fellow Swedish entrepreneur Martin Lorentzen.

CEO: Daniel Ek (2006 - Present)

The classic example of an introverted leader, Ek – a lifelong entrepreneur and university dropout – has been blunt about his management philosophies and his struggle to develop his leadership abilities. He is a popular CEO, though; in addition to employing a decentralised form of management and maintaining a forthright approach to leadership, he has incorporated internal mobility. This means that, at his behest, employees do not work in the same job at Spotify for more than two years – staff members are routinely doing something different. Human resource experts would say this is a gamble, but it is undoubtedly one that is yielding results for Ek and his company.

CCO: Dawn Ostroff (2018 - Present)

As discussed, content – and the acquisition of that content – is central to everything that Spotify does. Therefore, the Chief Content Officer (CCO) has a vital role to play.

Dawn Ostroff, the former Entertainment President of The CW Network, has been at the company since August 2018 and has been integral in landing some of Spotify's biggest and most lucrative partnerships. What makes her such a valuable asset is her ability to tap into untapped revenue potential, a skill she has demonstrated shrewdly in her previous appointments. Through identifying revenue streams that her predecessors had ignored, she has added tens of millions of dollars to her employers' coffers; long-term, Spotify is hoping for the same results.

CTO: Andreas Ehn (2006 - 2009)

Although he left the company back in 2009, Andreas Ehn – the company's first-ever hire – was responsible for building and growing the technology and the support team for what is now one of the world's most widely used apps. By finding the right balance between user growth and team growth, Spotify was left in a much stronger position to meet user demand by the time he moved on.

Spotify's Branding Strategy

Despite making up much of its userbase, Spotify's brand strategy goes beyond just targeting younger demographics. As evidenced by its partnerships, the company is always looking to engage with a diverse clientele – young and old. But it is also utilising multi-channel marketing tactics that appeal to wider audiences.

In 2013, for example, it launched 30- and 60-second ad spots during the season premiere of NBC's The Voice, The Tonight Show with Jay Leno and Late Night with Jimmy Fallon. These programmes were – and are – popular with males and females in the 18-34, 18-49 and 25-54 demographics. In 2014, it released an advertising campaign entitled "Music Takes You Back" that was featured in movie theatres, on digital signage and across the internet; its purpose was to show how Spotify connects people.

The company is not afraid to demonstrate a sense of humour, too. For example, you may have seen its '2018 Goals' billboards and posters, which featured adverts that humorously exploited their user data. Indeed, analysis found that this campaign alone was responsible for tripling Spotify's revenue over a single quarter.

Competition

As with all serious industry disruptors, competition often follows, and several direct rivals have dented Spotify's market share, such as Jay-Z's Tidal. Today, Spotify controls around one-third of the music-streaming market, and the consensus is that it will continue to face challenges as established players pivot into this sphere.

Two such examples are Apple Music and Amazon Prime Music, with these two services each controlling about one-fifth to one-quarter of this market.

Spotify has competition from below, too, with thriving startups such as TuneIn, Pandora and 8Tracks all making ground, while the rise in popularity of vinyl suggests that non-digital music formats are not entirely dead (even if only accounting for a relatively minuscule proportion of purchases). As ever, piracy itself remains a threat, as well.

Spotify's Company Culture

As a tech-based disruptor revolutionising the way people consume, it's no surprise that Spotify promulgates the sort of hip, fresh and innovative company culture seen at the likes of Netflix, Patagonia and Google. Management aims to create positive social experiences for its workforce, with particular emphasis on fostering innovation, inclusion and teamwork; as the company itself asserts, “there is something for everyone.”

Spotify also promotes a democratic approach to the decision-making process. From designing office spaces, to selecting the types of benefits and perks available, the company aims to instil its values in its employees. This makes sense, considering that personalisation is a crucial tool for its service, with Spotify recognising that autonomy is a critical motivational factor in many tech-savvy workplaces.

---

Ultimately, Spotify's success is a case study in collaboration with brands – large and small; global and domestic. Spotify has achieved much of its growth by partnering with a diverse array of companies, as well as understanding the importance of the user experience – particularly in regards to their younger and more tech-savvy customers. On top of this quid pro quo relationship, Spotify’s rise to music streaming kingpin can also be attributed to its platform; if it were not satisfying to consumers, then it could not convert half of its free users into paid customers.

Key Takeaways:

- A Highly Functional Platform: You cannot attract new customers and retain current ones with an inefficient and problematic platform. For something as potentially volatile as streaming, the technology needs to be top-of-the-line, and if there are hiccups, then they need to be rectified immediately.

- Reach a Global Market: Spotify's reach is far and wide, and it would not have morphed into an audio streaming powerhouse if it did not branch out beyond the borders of Sweden. Examine the potential of your product to extend beyond local boundaries.

- Company Culture Reflects Corporate Values: How can you showcase your corporate values to the rest of the world if your company culture does not reflect those same values?

- Adaptation: Adapt or die – it is critical to adapt to consumer trends and changing landscapes. Otherwise, you risk losing your base and future prospects by failing to adapt to market developments.

For similar insights, don't forget to take a look at our breakdowns of Apple and Uber's business strategies, either!

What other lessons can we take from Spotify's business model? Let us know your thoughts in the comments below.