A holding company is a company that owns stock in another company (called the subsidiary), or that owns property such as real estate, patents, stocks and other assets. The goal of a holding company is not to produce goods or services but rather to own shares, to control its subsidiaries and to reduce risks for the owners.

Entrepreneurs set up holding companies to reduce risks and to protect themselves from the subsidiary’s losses. Indeed, if a subsidiary went bankrupt, the holding company would suffer a capital loss and a decrease in net worth. However, the total loss would be limited to the investment in the subsidiary and the subsidiary’s creditors could not pursue the holding company for additional remuneration. This is one of the major benefits of a holding company.

Entrepreneurs also use holding companies to protect their assets. Instead of personally owning assets such as real estate and stocks - thus putting themselves at risk for debt and potential lawsuits - entrepreneurs set up holding companies to own their personal assets. In case of bankruptcy, the loss would be limited to the company’s assets and the entrepreneur’s assets would be protected.

A holding company can either own a portion of its subsidiary’s stock, or can own 100% of the stock of its then-called ‘wholly owned subsidiary’. A holding company has operational and strategic control over its wholly owned subsidiaries and directs how its assets are invested. The overall control is usually less for a subsidiary with overseas operations. Nonetheless, the holding company may still benefit from possessing a wholly owned subsidiary in a different location and from sustaining operations in various geographic markets. Structuring a company internationally can limit tax liability by strategically basing certain aspects of the business in countries with lower tax rates and can hedge against geopolitical risk factors.

Benefits of a Holding Company in Singapore

Entrepreneurs who are looking to register a holding structure determine the location according to several factors, such as the taxes they are required to pay. Singapore is an ideal location for holding companies, and is sometimes preferred over Switzerland and the Netherlands. For example, capital gains are not taxable in Singapore, which is not always the case in Switzerland and in the Netherlands. Registering a company in Singapore may be a wise decision as it offers multiple benefits to its shareholders.

Opening a Company in Singapore Is a Simple Process

Singapore is regularly ranked as one of the easiest places to do business in the world, based on various factors affecting businesses, such as the ease of starting a business, tax matters, enforcing contracts and obtaining construction permits.

Singapore Has Double Taxation Agreements

Singapore is renowned for having large international trade activities and for attracting foreign investors with its double taxation agreements (DTAs). The DTA offers a reduction or an exemption of tax on specific categories of income to Singapore residents and to residents of the treaty partners. In other words, the DTA ensures that businesses and individuals who are Singapore residents and who derive income from a foreign jurisdiction are not subject to international double taxation. Additionally, the DTA ensures that businesses and individuals who are residents of the treaty partners and who generate income in Singapore are also not subject to international double taxation; Singapore has signed DTAs with several countries.

Singapore Has Strict Laws on Money Laundering and on Tax Evasion

The Inland Revenue Authority of Singapore (IRAS) carries out investigations in order to detect and to resolve tax evasion and fraud. Investigation activities may include surprise visits to the business premises as well as examination of accounting records, source documents and other pertinent records. Moreover, the Monetary Authority of Singapore (MAS) requires financial institutions to implement controls that identify and prevent the flow of illegal funds through the financial system. Therefore, financial institutions must identify their customers, review accounts regularly and report all suspicious transactions. Money laundering techniques sometimes involve statutory funds, which are funds life insurance companies are legally required to set aside to repay liabilities. Therefore, anti-laundering measures require a proof of legality for money that comes in Singapore, especially when it is destined to fill statutory funds.

Dividends Paid to Shareholders Are Exempt of Tax in Singapore

Singapore runs a one-tier corporate tax system, which means that the corporate tax rate is paid on the company’s profits and that the dividends paid to the shareholders are exempt of tax. The 17% corporate tax rate applies to companies incorporated in Singapore and to divisions of foreign companies, whether they are resident or not.

There are tax incentives for small to mid-sized companies summarized as follows:

0% tax on S$100,000 taxable income: For the first three tax years after incorporation, the corporate income tax rate is 0%, provided that the company meets the following criteria:

- is incorporated in Singapore

- is a tax resident in Singapore

- has no more than 20 shareholders (at least one of which is a physical person and holds at least 10% of shares)

8.5% tax on taxable income up to S$300,000: All Singapore companies are eligible for 8.5% tax exemption on taxable income up to S$300,000.

Above S$300,000: The normal tax rate of 17% will apply.

Foreign income, such as foreign dividends, is exempt of tax, provided that:

- The shareholder receiving the income is a Singapore tax resident.

- The income comes from a foreign jurisdiction with a headline tax of at least 15%.

- The income has already been subject to tax in that jurisdiction.

In other words, a Singapore parent company can be exempt from the taxation of dividends received only if the tax rate on income where the subsidiary is based is above 15%.

Holding Structures Are Popularly Used for the Issuance of Loans to Subsidiaries

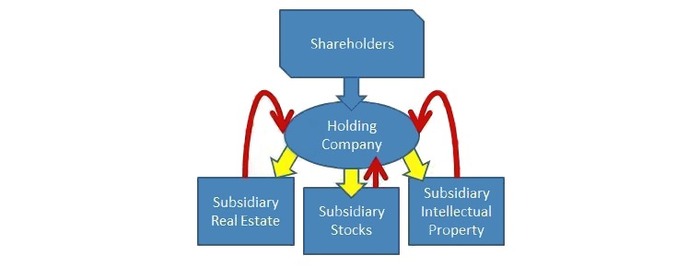

Let’s take a look at the following flowchart.

- The blue arrow shows the flow of funds when shareholders invest money in the holding company.

- The yellow arrows show the flow of funds when the holding company issues loans to its various subsidiaries. These subsidiaries act as silos and invest money in real estate, stocks and intellectual property. Creating subsidiaries limits risks, since putting assets in independent subsidiaries limits losses. If a subsidiary were to suffer losses, it wouldn’t affect the other subsidiaries and the total loss of the holding company would be limited to the investment in that subsidiary.

- The red arrows show the flow of interest paid on the loan to the holding company. It is easier for shareholders to manage one holding company with several subsidiaries, than to manage several different holding companies.

How a Company Can Obtain Tax Residence Status in Singapore

Companies with a tax resident status benefit from certain tax breaks on foreign income. Companies acquire the tax resident status in Singapore by applying for the Certificate of Residence (COR). The residency status may vary every year, and holding structures must be active in order to be considered as resident.

The residency status requires valid grounds for a company to become a tax resident in Singapore, and the following points reinforce the motives for obtaining and for maintaining the residency status:

- the company's Board of Directors meetings occur in Singapore;

- strategic decisions are made in Singapore;

- control and management is exercised in Singapore;

- the directors’ domicile is in Singapore; and

- the physical site of the books and records of the company is in Singapore.

Moreover, it is important to provide to the IRAS evidence that:

- the company is not for investment purposes;

- does not have foreign capital with income exclusively from foreign or passive sources; and

- is not a nominee company created only as a shareholder to foreign beneficiaries.

Indeed, when applying for residency, it would be difficult to justify implementing the company’s control and management as well as setting up operations in Singapore to the IRAS, if for instance, an investment holding company owned by a foreign company had passive sources of income or received only foreign-sourced income.

An individual's tax residency status determines the income tax rates.

The tax residency status is granted:

- to Singapore citizens and permanent residents who reside in Singapore; and

- to foreigners who have stayed in Singapore for 183 days or more in the year prior to the year of assessment.

Residents of Singapore pay progressive tax rates on their personal income. The highest tax bracket is associated with a personal income tax rate of 20%. Non-residents either pay the flat tax rate of 15% on employment income or the progressive resident tax rates, whichever tax amount is higher. The tax rate for director's fees, consultation fees and all other income is about 20%.

Opening a Corporate Bank Account in Singapore

Singaporean banks are among some of the safest in the world, and entrepreneurs can open a bank account for a Singapore company in any jurisdiction. Holding companies should have a bank account in their home country and another one in a foreign jurisdiction. Not all foreign banks in Singapore are full service banks. Additionally, foreign banks sometimes offer only a small number of branches and ATMs in Singapore. Moreover, offshore banks who face a significant time difference with Singapore may not offer round-the-clock service.

Entrepreneurs cannot open a corporate bank account at a local bank without being physically present in Singapore. Some international banks, such as HSBC, can verify the signature and passport at an overseas branch in front of a Notary Public and may be able to open a bank account. Nonetheless, personal meeting with bankers in Singapore will be required eventually.